Demat & Trading Account Opening Charges

Additional GST & Payment gateway fee available on selected plan

Lowest Cost Demat Account in the Industry

Watch real traders save big on m.Stock

₹ 1,20,000 brokerage a year or ₹ 0 brokerage for life? Choose wisely

Assuming 25 orders @ ₹20 brokerage and 20 trading days in a month

No Hidden Charges

| Charges | Equity Delivery | Equity intraday | Futures | Options |

|---|---|---|---|---|

| Brokerage | Zero | Zero | Zero | Zero |

| Call & Trade Charges | Zero | Zero | Zero | Zero |

| STT/CTT | 0.1% on buy & sell | 0.025% on the sell side | 0.02% on sell side | • 0.125% of the intrinsic value on options that are bought and exercised • 0.1% on sell side (on premium) |

| Transaction charges | NSE: 0.00322% BSE: 0.00375% |

NSE: 0.00322% BSE: 0.00375% |

NSE: 0.00188% | NSE: 0.0495% (on premium) |

| GST | 18% on (brokerage + transaction charges + SEBI charges) | 18% on (brokerage + transaction charges + SEBI charges) | 18% on (brokerage + transaction charges + SEBI charges) | 18% on (brokerage + transaction charges + SEBI charges) |

| SEBI charges | ₹10 / crore | ₹10 / crore | ₹10 / crore | ₹10 / crore |

| Stamp charges | 0.015% or ₹1500 / crore on buy side | 0.003% or ₹300 / crore on buy side | 0.002% or ₹200 / crore on buy side | 0.003% or ₹300 / crore on buy side |

| Charges | Futures | Options |

|---|---|---|

| Brokerage | Zero | Zero |

| Call & Trade Charges | Zero | Zero |

| STT/CTT | No STT | No STT |

| Transaction charges |

NSE: Exchange txn charge: 0.0009% |

NSE: Exchange txn charge: 0.035% |

| GST | 18% on (brokerage + transaction charges) | 18% on (brokerage + transaction charges) |

| SEBI charges | ₹10 / crore | ₹10 / crore |

| Stamp charges | 0.0001% or ₹10 / crore on buy side | 0.0001% or ₹10 / crore on buy side |

| Charges | Pay Later (MTF) |

|---|---|

| Interest Rate | 6.99% - 9.99% |

| Brokerage | ₹20/order |

| Subscription Fee | Zero |

| Pledge Charges | ₹32^^ |

| GST | 18% on (brokerage + transaction charges) |

Mutual Fund Charges ![]()

No fees on Mutual Fund Direct Plans

DP (Depository Participant) Charges ![]()

₹18 + GST per ISIN per transaction per day will be charged as DP sell transactions charges

Pledge Charges

- Pledge creation & closure charges will be ₹32 per PSN (Pledge Sequence Number) per day (+GST) for Pay Later (MTF) orders

- Pledge creation & closure charges will be ₹0 & ₹32 respectively per PSN (Pledge Sequence Number) per day (+GST) for Pledge Shares facility.

Quarterly Operating Charges

- ₹219 + GST per quarter for clients

- Clients can opt for 'Lifetime free operating charges' by paying a one-time fee of ₹1,299 + GST once their account is activated

Upgrade Charges

- Brokerage Plan: In case you opt for Free Delivery account during account opening and upgrade to ‘Zero Brokerage account’ later, then you will have to pay ₹1,299.

- Operating Charges: You have an option to upgrade to ‘Lifetime free operating charges’ later, by paying a one-time fee of ₹1,299.

Off-market Transfer Charges

Transfer in FREE - Transfer out ₹20 per transaction or 0.50% whichever is lower

Corporate Action Order Charges ![]()

No charge will be applicable for corporate action order

Delayed Payment Charges

Interest is levied at 24% a year or 0.066% per day on the debit balance in your trading account

Investor protection funded trust

- Equity: ₹10 per crore

- Options: ₹50 per crore

Physical CMR Request ![]()

No charge will be applicable for physical CMR request

Payment Gateway Charges - Margin Fund Transfer

UPI & Smart Pay Transactions are Free and in case of Net banking, charges will vary between ₹7 - ₹11 + GST depending on the bank selection

Physical Statement Courier Charges

₹100 per request + ₹100 per courier

Demat per certificate ![]()

No charge will be applicable for demat per certificate

Remat Charges ![]()

No charge will be applicable for remat

Failed Instruction Charges ![]()

No charge will be applicable for failed instruction

Reactivation Charges ![]()

No charge will be applicable for reactivation

Modification charges ![]()

No charge will be applicable for modification

Account Closure Charges ![]()

No charge will be applicable for account closure

18% GST

On Brokerage, DP charges, Exchange Transaction charges, SEBI charges and Auto Square-Off charges

Physical Delivery of Derivatives ![]()

No charges will be applicable for physical delivery of derivatives

Transaction/Turnover Charges

BSE transaction charges on securities traded in X, XT and Z group is 0.10% per crore & for 'P', 'ZP', 'SS' and 'ST' group, it is 1% per crore on the gross turnover value

Other Charges

- RMS square-off-charges for open intraday positions by system - ₹100 per position

- Auction if unable to deliver a stock (not in demat) - As per actual penalty by exchange

999 Account

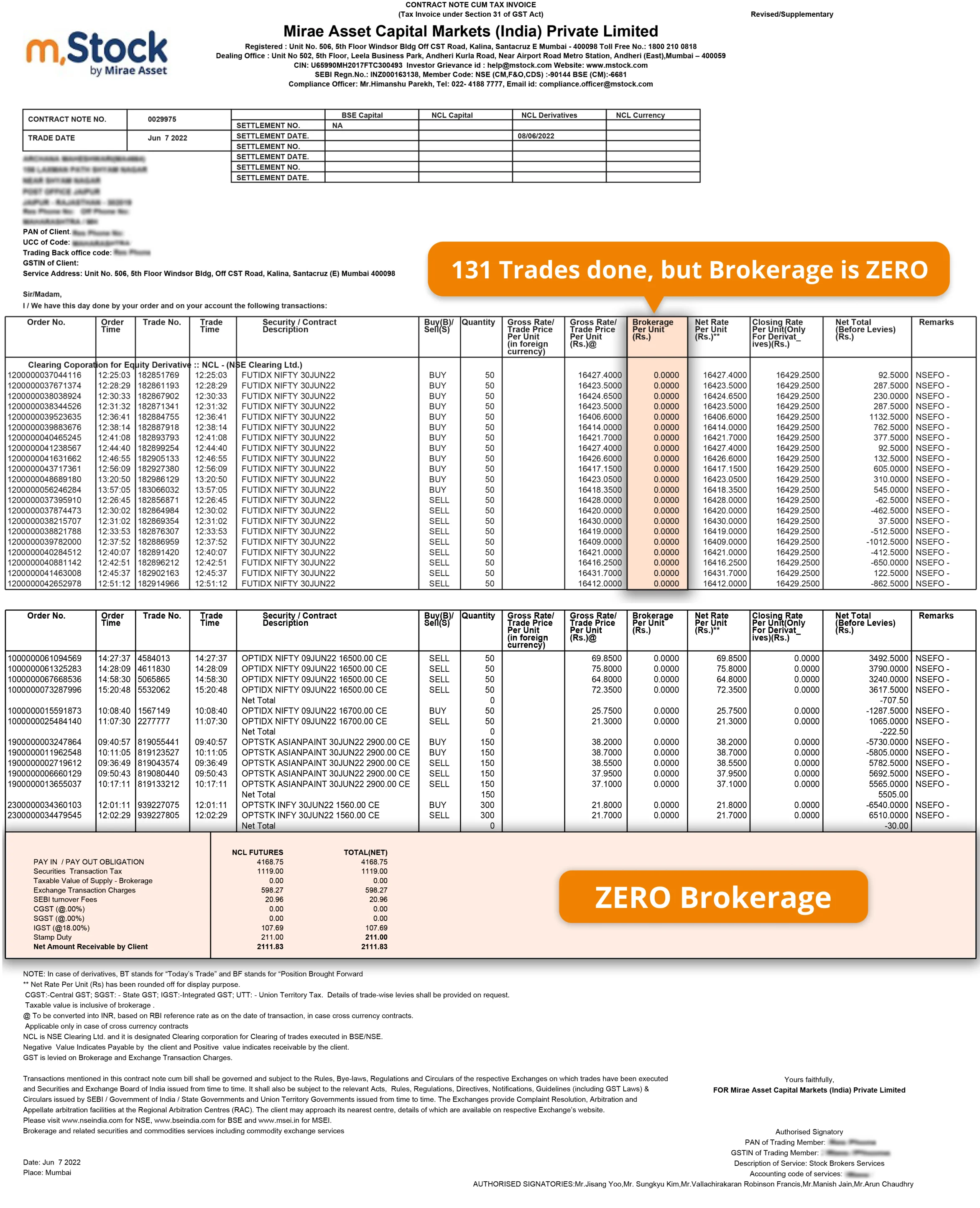

With this account, you will be charged a one-time Account opening fee of Rs.999, where you get to trade across all products @ Zero brokerage. This is a not a recurring charge. Zero brokerage charges are not linked to any subscription pack, or a limited number of trades and this is not a limited time offer.

149 Account

With this account, you will be charged a one-time Account opening fee of Rs. 149, subsequently you will be charged at Rs. 20 per trade across products. Delivery trades, Mutual Funds & IPOs are @ Zero brokerage.

Demat AMC

FREE for Life

With 999 Account & 999 AMC - you get a ZERO charges account without any Catch

Here's what the world has to say

“When I opted for the ₹999 Zero Brokerage plan, I was expecting a long list of T&C but it is truly a zero brokerage platform. Simply WOW!”

“Having carefully understood the m.Stock zero brokerage & pricing model, I can say with confidence that it is unmatchable in the current market.”

“When I heard that m.Stock is a zero brokerage platform I thought it was some sort of a scheme or scam. But, to my surprise, it is CLEARLY not! It is a perfect app for Indian small traders.”

“Zero Brokerage sounded too good to be true but still I chose ₹ 999 account & was surprised to find that there were no hidden charges. I also opted for the free AMC by paying an additional ₹ 999.”

“Get Zero Brokerage for life at one time fee ₹999 across products for life! A biggest revolution in broking industry! Hats off team Mirae!”

“My account opening process on m.Stock trading app was incredibly simple. A hassle-free investment with a one-time cost of Rs.999.”

Power your investments with our smart trading platforms