the lowest interest rates

Up to ₹25 lakh

0.0411% (14.99% p.a)

₹25 lakh to 5 crore

0.0274% (9.99% p.a)

Above ₹5 crore

0.0192% (6.99% p.a)

What is Pay Later (MTF)?

MTF is a equity delivery funding product where you can get additional capital for investing from the broker. With m.Stock, you get up to 80% funding instantly in 1,000+ stocks at one of the lowest interest rates starting from 6.99% p.a. (0.0192% per day).

- Available Margin₹1.75 crore

- m.Stock Pays₹5.26 crore

- You can buy stocks worth₹7.02 croreInterest rate

applicable6.99%

The Pay Later (MTF) advantage with m.Stock

- Low haircut. High funding

(Up to 80%) - Unlimited holding period

- ₹0 cash MTF orders

using Pledge - Zero subscription fees

- Instant funding to buy

Stocks & ETFs - MTF ledger for 100% transparency

Big savings on MTF interests!

Top Saver

Mr. Rajeevan

Kerala

₹62,47,016

Top Saver

Ms. Lunkad

Gujarat

₹44,74,700

Top Saver

Ms. Sharma

Delhi

₹39,02,752

Here is an example of a trade with and without Pay Later (MTF)

| No MTF Customer A | Uses MTF Customer B | |

|---|---|---|

Self capital | 60,000.00 | 60,000.00 |

| MTF Funding | - | 2,40,000.00 |

| Total invested capital | 60,000.00 | 3,00,000.00 |

| Purchase price per share | 300.00 | 300.00 |

| Total shares purchased | 200.00 | 1,000.00 |

| Current market price per share | 375.00 | 375.00 |

| Current value of investment | 75,000.00 | 3,75,000.00 |

| Gross profit / (loss) | 75,000.00 | 1,35,000.00 |

| MTF interest (0.0411% per day for 180 days) | - | 17,755.20 |

| Brokerage | - | 10.00 |

| Profit / (Loss) (only using MTF funding) | NA | 1,17,234.80 |

| Net profit / (Loss) (after deducting purchase price) | 15,000.00 | 57,234.80 |

| Return on Investment | 25.0% | 95.4% |

Pay Later (MTF) vs Pledge Shares

| Differences | Pay Later (MTF) | Pledge Shares |

|---|---|---|

| Purpose | Allows leveraging on available fund | Allows using existing holdings as collateral |

| Collateral required | None | Existing shares in the Demat account |

| Interest charges | Charged on the overall funding | Charged on the margin utilised |

| Risk of charges | Based on purchased stock performance | Higher in volatile market conditions |

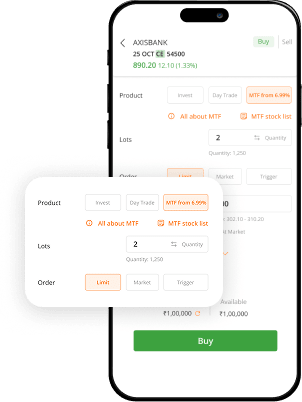

Avail Pay Later (MTF) with m.Stock in 3 quick steps

- 1

Select stock and enter quantity

- 2

Select Pay Later (MTF)

- 3

Place your BIG order

FAQs

What is Pay Later (MTF)?

Pay Later (MTF) is a leverage product that allows you to get funding from m.Stock for up to 80% of your investment in equity. You can avail Pay Later (MTF) for over 1070+ stocks at one of the lowest interest rates starting from 6.99% p.a.

Can new or beginner investors benefit by availing Pay Later (MTF)?

One of the biggest pain points of a beginner in the share market is insufficient capital and by availing Pay Later (MTF), you can overcome this problem. With Pay Later (MTF), beginners can leverage their limited capital and trade big. Especially with m.Stock Pay Later (MTF), as investors get up to 80% funding it becomes easier for a beginner to start investing in more meaningful positions that can also help in maximising the return potential. So, beginners with a capital of ₹10,000 can get funding of ₹40,000, helping them place trades worth ₹50,000. Similarly, beginner investors can place trades worth ₹2,50,000 against a capital of ₹50,000. The funding percentage varies depending upon the stock.