What are Stocks?

Stocks are securities that gives the buyer (shareholder) proportionate ownership of the company. Basis market capitalisation, stocks can be divided into large cap or bluechip stocks, midcap stocks and small cap stocks.

m.Stock offers smart web and app platforms for all your investment needs where you can place Unlimited Equity Delivery orders at ZERO brokerage.

- 20+tools

- Real-timedata

- 24*7assistance

6 reasons to start investing with m.Stock

- ₹0 brokerage on Delivery orders

- 1-click selling with DDPI

- Pledge holdings & get instant margin using Pledge Shares

- ₹0 Account Opening fee

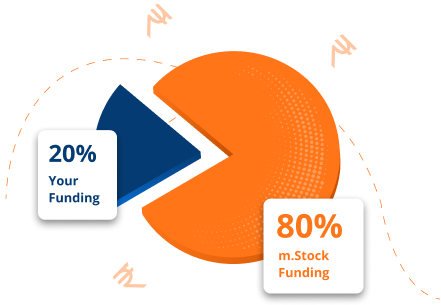

- MTF at one of the lowest interest rates starting from 6.99% p.a. (0.0192% per day)

- Advanced tools for every investment strategy

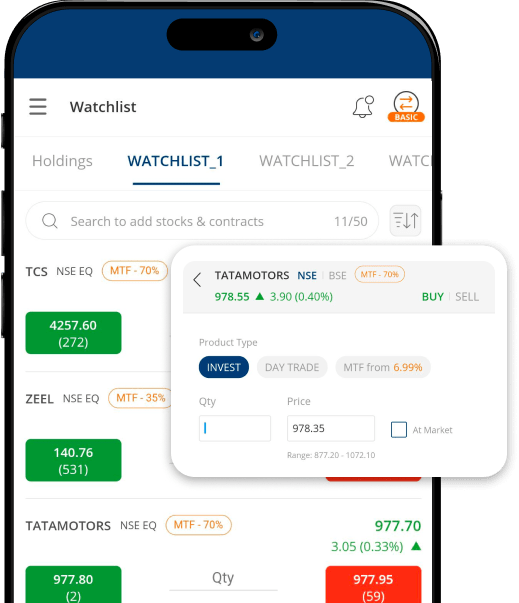

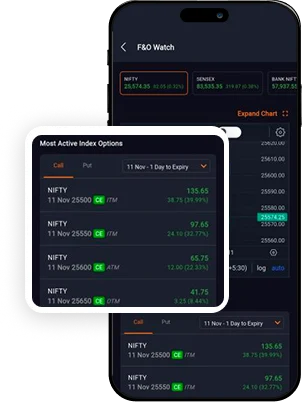

Powerful. Stable. Secure. Trading platform

- F&O WatchTrack all market data at one place

- Watchlist PROPlace 1-click orders from watchlist

- Trade from charts real timeOrder from live TradingView charts

- Research and Smart Advisory PortfoliosInvest smarter with expert calls & curated portfolios

- Advanced order formSmart orders with 1-click execution on baskets & GTT

Efficient trading: 20+ tools | Assured safety: World-class security

Over ₹650 crore brokerage saved!

Top Saver

Mr. Khurana

Delhi

₹63,86,702

Top Saver

Mr. Sawant

Maharashtra

₹50,43,556

Top Saver

Mr. Kanoj

Maharashtra

₹42,96,804

Start your investment journey

Explore stock investment opportunities

Take informed decisions using real-time market updates, fundamental & historical data

- Top Gainers

- Top Losers

- 52 Week High

- 52 Week Low

- Active by Volume

- Active by Value

Multiply your investment opportunities!

Enjoy unlimited holding period with

- ₹5 brokerage: Intraday, F&O, and MTF

- ₹0 brokerage: Delivery, IPO & MF

- ₹0 account opening fee

- ₹0 AMC

- ₹5 brokerage: Intraday, F&O, and MTF

- ₹0 brokerage: Delivery, IPO & MF

- ₹0 account opening fee

- ₹0 AMC

Open your FREE Demat account today!

Passive vs Active Investing

| Differences | Passive Investing | Active Investing |

|---|---|---|

| Approach | Buying and holding stocks for long term | Buying and selling for quick gains from market trends |

| Goals | Match market performance | Beat market trends through stock selection and timing |

| Management | Minimal; requires little active decision-making | Hands-on, often requires professional fund managers |

| Risk | Lower (diversified and less prone to market timing) | Higher (depends on individual decisions and timing) |

| Cost | Lower expense ratios and fees | Higher fees due to frequent orders and management |

| Time | Requires less time and effort to manage | Requires significant research and attention |

| ROI | Steady, market-average returns over time | Potential for high returns (also prone to losses) |

Types of stock trading

Intraday Trading

Buying and selling stocks within the same trading dayDelivery Trading

Buying stocks and holding them in their demat account for long termSwing Trading

Buying and selling stocks within days or weeks to benefit from short- to medium-term price trendsPositional Trading

Long-term trading based on fundamental analysis and historical dataScalping

Quick trades based on price gaps or market trends for gains within a few minutesMomentum Trading

Trading stocks that show strong upward or downward trendsDerivative Trading

Buying or selling futures and options to hedge risks or speculate on price movementsAlgorithmic Trading

Trading using programs, models and APIs to execute orders based on pre-set criteria

Market News

View All

Ashok Leyland announces liquidation of step-down subsidiary - Ashok Leyland West Africa SA

Ashok Leyland announced that its step-down subsidiary, Ashok Leyland West Africa SA has been voluntarily liquidated.Powered by Capital Market - Live News

19 February 2026 | 11:27 AM

Bharat Forge signs MoU with VVDN Technologies

Bharat Forge and VVDN Technologies, a global provider of product engineering and manufacturing services have signed a Memorandum of Understanding (MoU) to record their broad understanding to explore a strategic collaboration across key technology-driven sectors.

Under the MoU, the parties intend to jointly pursue opportunities in next-generation technologies across the Automotive, Defenc...

18 February 2026 | 7:17 PM

Trent gains after Q3 PAT climbs 36% YoY to Rs 640 cr

Profit before exceptional items and tax stood at Rs 829.80 crore, up 34.19% compared with Rs 618.36 crore in Q3 FY25. Exceptional items during the quarter amounted to Rs 25.79 crore and were related to labour code charges. Adjusted PAT jumped 41% YoY to Rs 660 crore during the quarter.Operating EBITDA climbed 23% YoY to Rs 822 crore. In Q3FY26, the company opened 17 Westside and 48 Zudio stor...

5 February 2026 | 9:49 AM

Siemens board approves proposed merger with Siemens Rail Automation

The board of Siemens at its meeting held on 06 February 2026 has granted its in-principle approval for the proposed amalgamation of Siemens Rail Automation (SRAPL), a wholly owned subsidiary of the company with the company.Powered by Capital Market - Live News

6 February 2026 | 2:46 PM

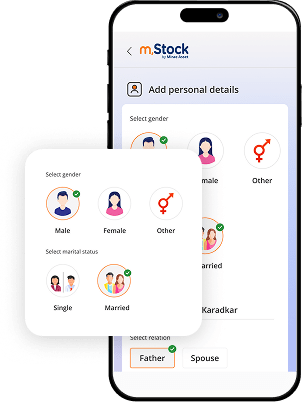

3 simple steps is all it takes

- 1

Enter personal details

- 2

Complete your documentation

- 3

Login and start investing

FAQs

Trading on equity is an action wherein a company raises debt to boost returns on investments. The funds are used to procure more assets that the company hopes will offer greater returns than the interest payable on the new debt. Companies borrow capital based on their equity. A company borrowing an amount larger than its equity is referred to as 'trading on thin equity'. If the amount borrowed is lower, it is called 'trading on thick equity'.