What are Futures & Options?

In Futures contracts, buyer and seller agree to trade the underlying asset at a predetermined price on a specific future date. Options contracts provide the buyer the right, but not the obligation, to buy or sell the underlying asset at a specific price on or before the expiry date.

m.Stock offers seamless web and app platforms with advanced features for faster trade execution.

- 20+tools

- Real-timedata

- 24*7assistance

F&O trading made smarter with m.Stock

- Unlimited F&O orders at just ₹5/order

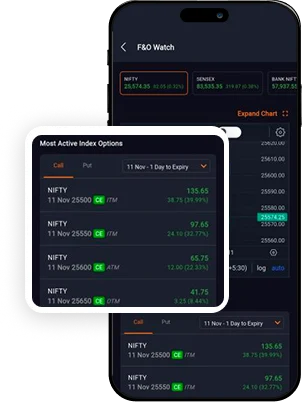

- Real-time data on OI & most traded F&O contracts

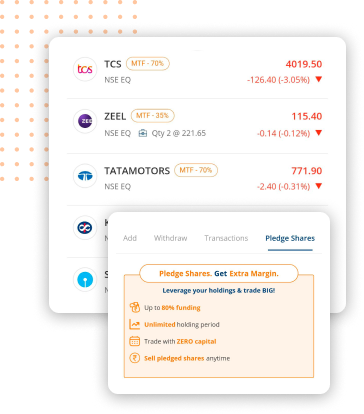

- Pledge shares & get up to 87.50% margin for unlimited holding period

- ₹0 Account Opening fee

- Powerful TradingView charts with 80+ indicators

- Superfast execution with Options Strategy Builder

Powerful. Stable. Secure. Trading platform

- F&O WatchTrack all market data at one place

- Watchlist PROPlace 1-click orders from watchlist

- Trade from charts real timeOrder from live TradingView charts

- Research and Smart Advisory PortfoliosInvest smarter with expert calls & curated portfolios

- Advanced order formSmart orders with 1-click execution on baskets & GTT

Uninterrupted experience: 7,467 trades/min

Efficient trading: 20+ tools | Assured safety: World-class security

Efficient trading: 20+ tools | Assured safety: World-class security

Over ₹650 crore brokerage saved!

Top Saver

Mr. Khurana

Delhi

₹63,86,702

Top Saver

Mr. Sawant

Maharashtra

₹50,43,556

Top Saver

Mr. Kanoj

Maharashtra

₹42,96,804

Start your savings today

OI Gainers & Losers

As on -| -

- Index

- Stock

Contracts

Expiry

24 February 2026

Gainers

| No Record Found | |||||

Losers

| No Record Found | |||||

Explore the Pre-defined Strategies

- Bullish

- Bearish

- Range Bound

- Other

Buy Call

Buy Call

Trade Now

Sell Put

Sell put

Trade Now

Bull Call Spread

Buy 1 ATM call & Sell 1 OTM call

Trade Now

Bull Put Spread

Buy 1 OTM put & Sell 1 ATM put

Trade Now

Call Ratio Back Spread

Sell 1 ATM call & Buy 2 OTM call

Trade Now

Long Calendar With Calls

Buy 1 long term call & Sell 1 short term call with same Strike price

Trade Now

Long Call Diagonal Spread

Sell 1 OTM call + Buy 1 one strike higher call with month expiry

Trade Now

Bull Condor

Buy 1 OTM call + Sell 1 higher call + Sell 1 higher call + Buy 1 higher call

Trade Now

Bull Butterfly

Buy 1 ATM call + Sell 2 OTM call + Buy 1 deep OTM call

Trade Now

Range Forward

Buy 1 OTM call & Sell 1 OTM put

Trade Now

Long Synthetic Future

Buy 1 ATM call & Sell 1 ATM put

Trade Now

“m.Stock par mera brokerage bilkul nil hai, chahe woh delivery ho chahe ETFs buying ho ya mutual funds. Sabhi mein brokerage zero hai.

Manoj Khandelwal

m.Stock customer, Mumbai

What are the different types of

Options contracts?

There are 2 basic types of Options contracts

Call Option

Provides the buyer the right (but not the obligation) to buy an underlying asset at a specified price within a certain time frame

Put Option

Provides the buyer the right (but not the obligation) to sell an underlying asset at a specified price within a certain time frame

Broadly, these contracts can be traded via 2 strategies as mentioned below

Long Option

Buying an option, either call or put, with the hope that the price of the underlying asset will move favourably

Short Option

Selling an option, either call or put, with the obligation to fulfil the contract if the buyer chooses to exercise it

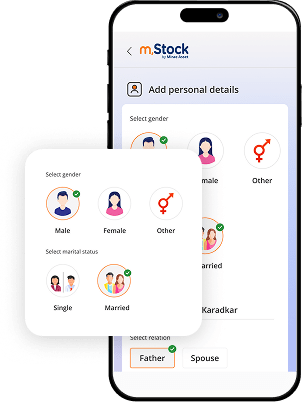

3 simple steps is all it takes

- 1

Enter personal details

- 2

Complete your documentation

- 3

Login and start investing

Start your investment journey

FAQs

In the investment world, futures and options are derivative instruments or contracts between buyers and sellers. Through these contracts, traders can invest in various types of market securities such as stocks, bonds, commodities, currencies, stock indexes, etc. The agreement essentially comprises the details of the investment, including investment amount, estimated buying/selling price, contract expiration date, and other significant facts based on which its value is derived.