Straddle Strategy in Options Trading

- Understanding what a straddle is

- How to implement a straddle strategy

- Role of Greeks in long and short straddles

- Trade mechanics of long and short straddles

In scenarios where market direction is uncertain, but a sharp move is anticipated, traders turn to non-directional strategies. Events such as national budgets, monetary policy announcements, major elections, or earnings results often bring this level of volatility and unpredictability.

To benefit from such explosive market movements, one of the most commonly used strategies is the Straddle.

What Is a Straddle?

A Straddle is a neutral options strategy where the trader buys both a call and a put option of the same underlying, with identical strike prices and expiry dates. This is known as a Long Straddle when both legs are purchased.

The strategy is profitable only if the underlying asset experiences a significant move, either upward or downward, before the options expire. The gain must exceed the cost paid to set up the straddle.

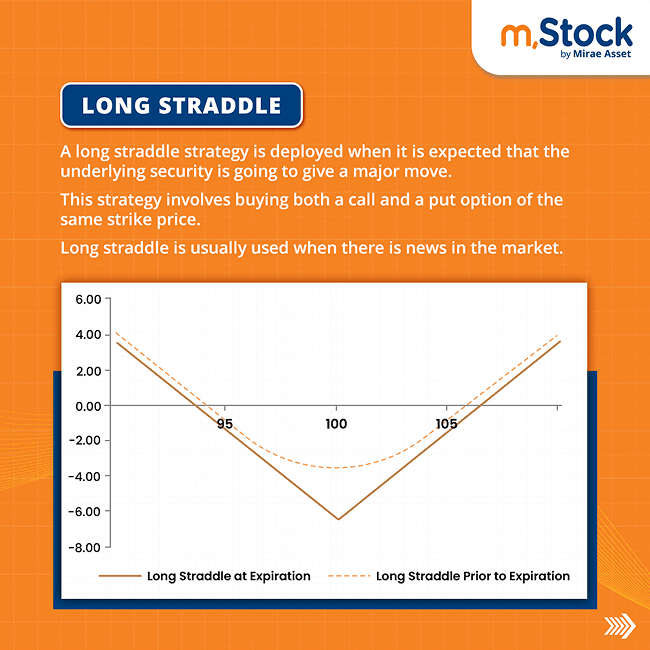

Long Straddle Payoff Diagram

To visualise the potential outcomes, consider the payoff diagram of a long straddle:

[Long Straddle Payoff]

This graph represents the outcome of holding both a long call and a long put.

Assume the Nifty is trading at 17,534.75. The closest at-the-money (ATM) strike is 17,550. A long straddle can be created by purchasing:

Nifty August 25th 17,550 Call (CE) at ₹238

Nifty August 25th 17,550 Put (PE) at ₹239.35

The strike price, expiry, and underlying are identical for both options.

Trade Dynamics

Total cost of the straddle = ₹238 + ₹239.35 = ₹477.35 (per unit)

For 1 lot of Nifty (50 units) = ₹23,867.50 + charges

This cost is also the maximum potential loss

This peak loss occurs if the market closes exactly at the strike price of 17,550 on expiry.

Breakeven Points:

Upper breakeven = 17,550 + 477.35 = 18,027.35

Lower breakeven = 17,550 - 477.35 = 17,072.65

The strategy yields unlimited profit potential if the market crosses either breakeven levels. It’s a risk-defined trade, with the maximum loss known upfront.

Greeks in Long Straddle

This strategy is typically Delta Neutral at initiation:

The ATM call has a delta of +50

The ATM put has a delta of -50

Net delta ≈ 0

Theta, the time decay Greek, becomes increasingly relevant as expiry nears. Trades placed close to expiry are more exposed to theta decay, while those with more time benefit from minimal decay.

Volatility is also critical. Traders typically initiate long straddles in low-volatility environments, as lower premiums reduce the cost. However, low volatility might also indicate that the market doesn’t expect much movement, potentially making the strategy less effective.

Short Straddle

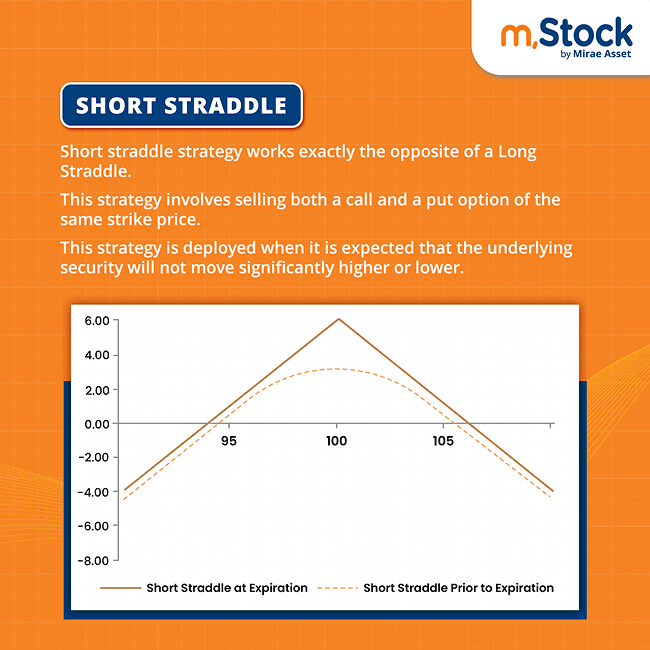

In contrast, a Short Straddle involves selling both the ATM call and put options of the same underlying, strike, and expiry. This strategy has a payoff diagram that mirrors the long straddle.

[Short Straddle Payoff]

Suppose the Nifty is still trading at 17,534.75. A short straddle can be constructed using:

Sell 17,550 CE at ₹238

Sell 17,550 PE at ₹239.35

Same expiry and underlying conditions apply.

Trade Dynamics

Total premium collected = ₹238 + ₹239.35 = ₹477.35 (per unit)

For 1 lot (50 units) = ₹23,867.50

This is the maximum profit, achieved if the market closes exactly at 17,550

Margin Requirement:

Approximately ₹124,817 is required to execute this trade.

Breakeven Points:

Upper breakeven = 17,550 + 477.35 = 18,027.35

Lower breakeven = 17,550 - 477.35 = 17,072.65

Although the maximum profit is limited to the premium received, the loss potential is unlimited if the market moves beyond the breakeven range.

Greeks in Short Straddle

Like the long version, the short straddle is Delta Neutral at entry:

Short call delta ≈ -50

Short put delta ≈ +50

Net delta = 0

However, Theta works in favor of the seller. Time decay accelerates as expiration nears, making this a popular intraday strategy among professional traders.

Short straddles are commonly used during event days with elevated volatility. Rising premiums offer better returns and a wider breakeven buffer, allowing traders to benefit from high implied volatility.

Higher IVR or IVP levels suggest better potential ROI but also bring higher risk if the market moves sharply.

Conclusion

Straddles, especially in their long form, are foundational strategies for new options traders on m.Stock. While long straddles offer unlimited reward potential, their success hinges on sharp market moves.

On the other hand, seasoned traders often prefer the short straddle for its higher probability of success, even though it carries the risk of unlimited losses.

Key Takeaways

A long straddle involves buying both call and put options of the same strike and expiry.

A short straddle involves selling both options under the same terms.

Long straddles require strong directional movement, while short straddles profit from market stagnation.

Delta neutral at initiation, both strategies are heavily influenced by Theta and Volatility.

Short straddles offer higher probability but come with higher risk exposure.