What is Mutual fund?

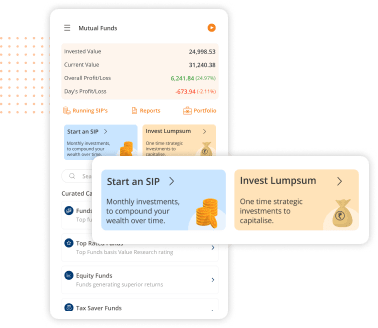

A Mutual Fund is a professionally managed investment fund, which collects (pools) money from investors and invests in different asset classes like Equity, Debt and so on as per the fund's objective. With m.Stock, you earn 1% higher returns via direct plans.

The Mutual Funds advantage with m.Stock

- 0 commission with direct plans

- Convenient 2-click SIPs

- Choose from 40+ AMCs & 3,500+ schemes

- SIPs starting from ₹100

- Easy investing with UPI mandates

Discover Mutual Funds

Equity Mutual Funds

Top Rated Fund

Funds with best returns

Tax Saver Funds

Better than FDs

- NAV46.404Min. SIP Amount₹1000Value Research1 Y Returns83.57%3 Y Returns38.4%5 Y Returns39.08%

- NAV76.64Min. SIP Amount₹500Value Research1 Y Returns61.17%3 Y Returns28.98%5 Y Returns31.67%

- NAV211.91Min. SIP Amount₹100Value Research1 Y Returns0.68%3 Y Returns24.75%5 Y Returns31.23%

Mutual Fund Calculator

Hit your financial goals with SIP

Start an SIP- Can start with just ₹100

- Build financial discipline

- Override market fluctuations

Benefits of Mutual Funds

- Portfolio diversification

Invest across sectors and asset classes to safeguard against market volatility

- Reduced risks

Diversification helps in protection against volatility especially in the short term

- Power of compounding

Benefit from returns on the initial investment plus its returns over time

- Convenient & flexible

Invest online as per your convenience and available funds

- Hedge against inflation

Invest in debt mutual funds to mitigate inflation

- Rupee cost averaging

With SIPs, you don't have to worry about timing the market well anymore

Types of Mutual Funds

Access debt markets and enjoy interest income from bonds and debentures. Ideal for conservative short-term investors

Enjoy best of both the worlds - equity and debt. Ideal for beginners with medium-term investment horizon

Why Direct Mutual Funds is the way to go?

| Regular Mutual Funds | Direct Mutual Funds | |

|---|---|---|

| 1Low Expense Ratio | Higher due to distributor commission | Lower due to absence of distributor commission |

| 2Higher Net Asset Value (NAV) | May have a comparatively lower NAV | Generally higher due to lower expenses |

| 3Higher Returns | Returns may be lower due to higher expenses | Potential for higher returns |

| 4Transparency | Intermediary involvement may impact clarity | Direct interaction with the fund house fosters transparency |

FAQs

What are direct mutual funds?

There are two types of mutual fund plans in India – Regular and Direct. Regular plans are ones which are done through an investment advisor or mutual fund distributor. Since the investor goes through an agent, the fees or commission payable to the agent are adjusted in the fund’s Net Asset Value (NAV). On the contrary, Direct mutual funds are purchased directly from the asset management company and thus eliminates costs related to third party agents or distributors. This ‘cost-saving’ has a direct impact on the fund’s expense ratio. Regular plans have higher expense ratio compared to direct plans and hence the ‘in-hand’ returns generated by direct mutual funds are higher than regular funds. By investing in direct plans, you can earn up to 1% additional returns on your investments.

Can I save tax using mutual funds?

What asset classes are available in mutual funds?

Mutual funds are a great way to diversify your portfolio. While there are endless subsets of mutual funds, the three core asset classes in mutual funds are equity, debt, and hybrid. Equity funds invest in equity stocks of companies listed on the stock exchange. They carry medium to high risk and range from relatively safer investments like large cap funds to risky investments (mid and small cap funds). Debt funds are comparatively safer as they invest in fixed interest generating investments like fixed deposits, commercial papers, certificates of deposits, treasury bills etc. They are ideal for conservative investors looking to beat inflation without exposing their capital to equity markets. Hybrid funds are a mix of both equity and debt. There are six types of hybrid funds each with a unique mix of equity and debt. These are ideal for beginners to test the waters, before going all in with equities.