Overview

- Open-

- High-

- Low-

- Prev. Close-

- O.I

- O.I Change %-

- Prev. Open Interest-

- Type-

- Volume

- Spot Price-

- Rollover Cost-

- Rollover %-

Chart

- 1D

- 1W

- 1M

- 3M

- 6M

- 1Y

- 3Y

- 5Y

- All

News

Gold faces resistance from stronger dollar, firmer rupee

Hot Commodities: Silver hits record highs as Dollar and markets await policy signals

Currency Buzz: INR crashes past Rs 91 per dollar mark during intraday moves

Gold edges toward record highs as Rupee rout and soft Dollar amplify gains

INR crashes further; Slides beyond Rs 90.50 per dollar mark

Currency Buzz: Rupee slips to fresh lifetime lows; Falls towards Rs 90.50/$ mark

Gold eases on profit-taking but dollar weakness offers support

Global crude firms while MCX softens; Rupee slides to new lows

Currency Buzz: Rupee continues to loiter beyond historic Rs 90/$ mark; Uptick in local equities likely to cap further downside

Currency Buzz: Rupee slumps to fresh record low; Seen at risk of slipping past Rs 90/$ mark

FAQs

What is JPY/INR Trading & How to Trade in it?

JPY/INR trading, also known as forex trading, involves buying one currency while simultaneously selling another, in pairs. The objective is to profit from changes in the exchange rates between the two currencies, by selling high and buying low. To trade in forex, you need to open a forex trading account with a SEBI and RBI authorised broker, link your bank account, deposit funds, and then place buy or sell orders based on your market analysis. Remember, successful trading requires understanding market trends, economic indicators, and geopolitical events that influence currency values.

What are the currency trading hours in India?

In India, currency trading typically operates from 9:00 AM to 5:00 PM IST, Monday to Friday. However, if you’re trading in cross-currency pairs, it can be done till 7:30 PM on weekdays. This schedule allows traders to engage in forex markets during India's business hours. The global forex market, though, runs 24 hours a day, five days a week, due to different time zones of major financial centres like New York, London, Tokyo, and Sydney. This continuous operation offers opportunities for Indian traders to engage in currency trading through international brokers even outside Indian market hours.

What affects the price of the JPY/INR pair?

The price of a JPY/INR pair is influenced by various factors including interest rates, economic indicators, geopolitical events, and market sentiment. Central bank policies, inflation rates, and economic data releases like GDP, employment numbers, and manufacturing indices can cause significant fluctuations. Political stability and international trade relationships also play crucial roles. Additionally, market sentiment and speculative activities by traders can impact currency prices. Understanding these factors can help you make informed trading decisions.

What to watch out for when trading JPY/INR?

When trading JPY/INR pairs, it's crucial to watch economic indicators, interest rate decisions, and geopolitical events that may impact currency values. Pay attention to Central bank policies, inflation rates, employment figures, and GDP growth. Technical analysis, including chart patterns and trading volumes, can provide insights into market trends. Additionally, staying updated on global news and market sentiment is essential to anticipate market movements. Effective risk management strategies, such as setting stop-loss orders, can help protect your investments. Apart from these factors, it is vital to choose a reliable trading platform that offers features, services, and insights for successful currency trading. Other aspects to watch out for include associated brokerage and platform usage costs and your personal and financial data security.

How can I do currency trading via m.Stock?

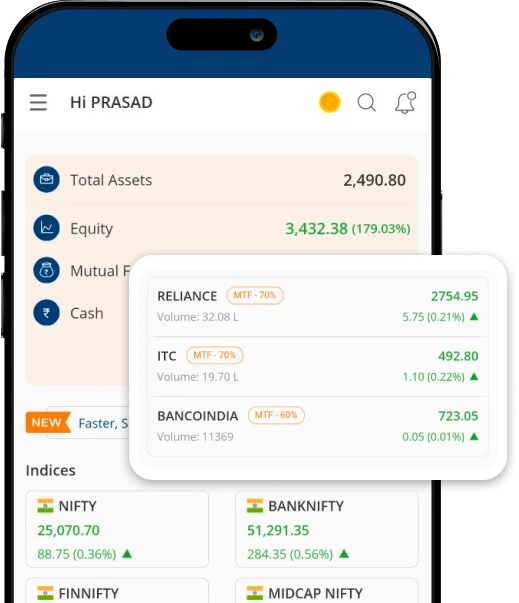

m.Stock by Mirae Asset offers a seamless currency trading experience. To trade currencies via m.Stock, first, open a trading account with m.Stock and complete the KYC process. Once your account is active, deposit funds into it. Enable the currency trading segment and navigate to the forex trading section. Select the currency pair you want to trade, and place your buy or sell order based on your market analysis. m.Stock offers various tools and resources for market analysis, including real-time data, charts, and economic indicators. Utilise these tools to make informed trading decisions and manage your portfolio effectively.