What are Stocks?

Stocks are securities that gives the buyer (shareholder) proportionate ownership of the company. Basis market capitalisation, stocks can be divided into large cap or bluechip stocks, midcap stocks and small cap stocks.

m.Stock offers smart web and app platforms for all your investment needs where you can place Unlimited Equity Delivery orders at ZERO brokerage.

- 20+tools

- Real-timedata

- 24*7assistance

6 reasons to start investing with m.Stock

- ₹0 brokerage on Delivery orders

- 1-click selling with DDPI

- Pledge holdings & get instant margin using Pledge Shares

- ₹0 Account Opening fee

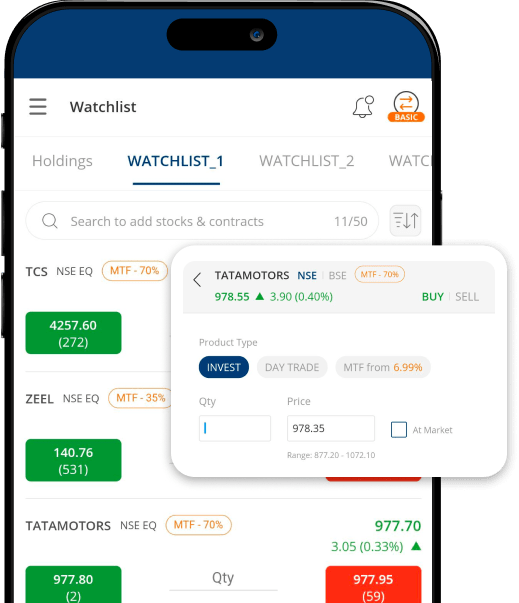

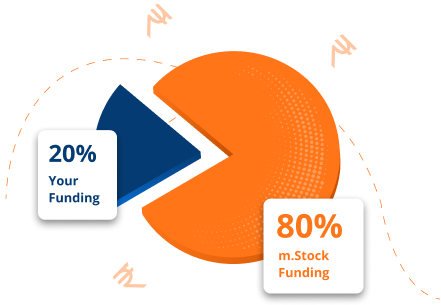

- MTF at one of the lowest interest rates starting from 6.99% p.a. (0.0192% per day)

- Advanced tools for every investment strategy

Powerful. Stable. Secure. Trading platform

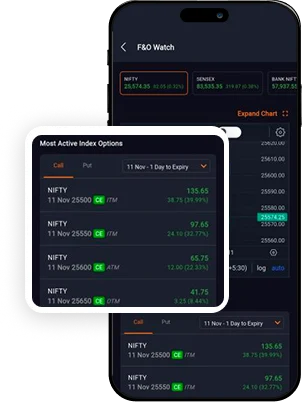

- F&O WatchTrack all market data at one place

- Watchlist PROPlace 1-click orders from watchlist

- Trade from charts real timeOrder from live TradingView charts

- Research and Smart Advisory PortfoliosInvest smarter with expert calls & curated portfolios

- Advanced order formSmart orders with 1-click execution on baskets & GTT

Efficient trading: 20+ tools | Assured safety: World-class security

Over ₹650 crore brokerage saved!

Top Saver

Mr. Khurana

Delhi

₹63,86,702

Top Saver

Mr. Sawant

Maharashtra

₹50,43,556

Top Saver

Mr. Kanoj

Maharashtra

₹42,96,804

Start your investment journey

Explore stock investment opportunities

Take informed decisions using real-time market updates, fundamental & historical data

- Top Gainers

- Top Losers

- 52 Week High

- 52 Week Low

- Active by Volume

- Active by Value

Multiply your investment opportunities!

Enjoy unlimited holding period with

- ₹5 brokerage: Intraday, F&O, and MTF

- ₹0 brokerage: Delivery, IPO & MF

- ₹0 account opening fee

- ₹0 AMC

- ₹5 brokerage: Intraday, F&O, and MTF

- ₹0 brokerage: Delivery, IPO & MF

- ₹0 account opening fee

- ₹0 AMC

Passive vs Active Investing

| Differences | Passive Investing | Active Investing |

|---|---|---|

| Approach | Buying and holding stocks for long term | Buying and selling for quick gains from market trends |

| Goals | Match market performance | Beat market trends through stock selection and timing |

| Management | Minimal; requires little active decision-making | Hands-on, often requires professional fund managers |

| Risk | Lower (diversified and less prone to market timing) | Higher (depends on individual decisions and timing) |

| Cost | Lower expense ratios and fees | Higher fees due to frequent orders and management |

| Time | Requires less time and effort to manage | Requires significant research and attention |

| ROI | Steady, market-average returns over time | Potential for high returns (also prone to losses) |

Types of stock trading

Market News

View All

Ashok Leyland Jan sales jump 27% to 21,920 units

Ashok Leyland reported total sales of 21,920 units in month of January 2026 compared to 17,213 units in January 2025, recording a growth of 27%. Total sales include domestic sales of 20,079 units (up 31% YoY).Powered by Capital Market - Live News

1 February 2026 | 2:07 PM

Asian Paints rises as broker flags crude tailwind, easing competition

Brent crude, a key raw material for paint makers, was down around 5% on the day, providing relief on input costs.The brokerage expects Asian Paints to deliver volume growth of about 11% in Q4, aided by improving cost dynamics and a shift toward more rational competitive behaviour in the industry. It noted that a new paint entrant is likely to adopt a more measured strategy following price hik...

2 February 2026 | 2:56 PM

Board of Bharat Forge recommends interim dividend

Bharat Forge announced that the Board of Directors of the Company at its meeting held on 12 February 2026, inter alia, have recommended the interim dividend of Rs 2 per equity Share (i.e. 100%) , subject to the approval of the shareholders.Powered by Capital Market - Live News

12 February 2026 | 1:55 PM

Blue Star records over 39% YoY fall in Q3 PAT; order book stands at Rs 6,898.74 crore

The company's revenue from operations increased by 4.2% to Rs 2,925.31 crore for the quarter ended 31 December 2025, as compared to Rs 2807.36 crore during the same period in the previous year.

Revenue of segment 1, comprising of Electro-Mechanical Projects, Commercial Air Conditioning Systems, Service and International Business, grew by 8.6% to Rs 1,696.21 crore in Q3 FY26, as compared to...

30 January 2026 | 12:00 PM

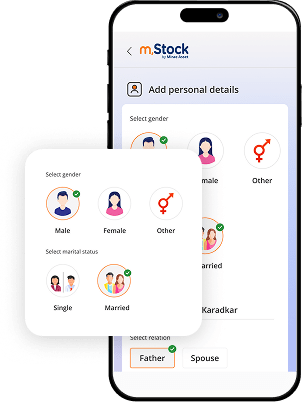

3 simple steps is all it takes

- 1

Enter personal details

- 2

Complete your documentation

- 3

Login and start investing

FAQs

Trading on equity is an action wherein a company raises debt to boost returns on investments. The funds are used to procure more assets that the company hopes will offer greater returns than the interest payable on the new debt. Companies borrow capital based on their equity. A company borrowing an amount larger than its equity is referred to as 'trading on thin equity'. If the amount borrowed is lower, it is called 'trading on thick equity'.