What Are Trendlines?

- Learn the role of trendlines in technical analysis

- How to draw and identify trendlines accurately

- Understand various types of trendlines and what they indicate

- Analyse how support and resistance levels are breached using trendlines

As we wrap up Module 4, let’s explore trendlines—a fundamental yet powerful tool in technical analysis, widely used to decode price action. In essence, trendlines are diagonal lines drawn between key swing points (major highs or lows) to determine the prevailing trend of a stock or market. These points serve as dynamic support and resistance zones.

Unlike static horizontal levels, trendlines slope, either upward or downward, signalling the market’s directional bias.

Upward sloping trendlines reflect rising demand and potentially higher prices

Downward sloping trendlines indicate increasing supply and potential price declines

How to Draw Trendlines

A minimum of two swing highs or lows is essential to draw a trendline

Uptrend line: Connects two or more swing lows, indicating support

Downtrend line: Connects two or more swing highs, signalling resistance

Start by locating a significant high or low, then link it to the next logical swing point

A trendline with three or more touchpoints gains strength and credibility

If a line has five or more touches, the probability of a breakout increases

Candlestick overlaps are acceptable, but the line must not cut through the candle body

Angles of Trendlines

The angle of a trendline reflects the strength of a trend. Commonly, traders prefer angles between 30° to 45° for balanced trend analysis.

Steeper uptrend lines (more than 45°) suggest strong buying interest

Gentler slopes may indicate weaker demand

Similarly, steep downward lines suggest intense selling pressure

Angles help gauge the momentum behind price movements

Trendline Sloping Up & Down

Visualizing trendlines sloping upward or downward gives clear insight into market direction.

An upward trendline marks area where demand consistently steps in

A downward trendline highlights zones where supply repeatedly dominates

Timeframes for Drawing Trendlines

Always begin with higher timeframes (daily, weekly) when plotting trendlines

Trendlines drawn on higher timeframes carry more weight and visibility

Once established, these lines act as strong support/resistance across lower timeframes

This enhances their predictive and trading value

Trading the Trendlines

Trading using trendlines can be categorized into breakouts and bounces.

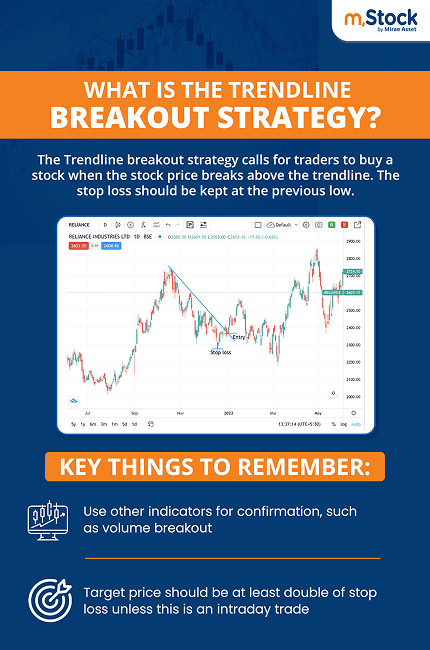

1. Trendline Breakouts

A breakout occurs when the price moves beyond the trendline, either upward or downward.

In an uptrend, a breakout happens below the trendline

In a downtrend, a breakout occurs above the trendline

A short-term counter-trendline may emerge within the main trend during a retracement, providing breakout opportunities in the direction of the original trend

Example:

In an uptrend, trendlines are drawn using swing lows

During a pullback, another line is drawn across lower highs. If the price breaks above this inner line, it may resume the uptrend

In a downtrend, the trendline joins swing highs

During a bounce, a short-term line across swing lows can serve as a breakout trigger in favor of the prevailing downtrend

2. Trendline Bounces

A bounce happens when the price touches the trendline and rebounds in the direction of the trend.

In an uptrend, price may retrace to the trendline and bounce upward, indicating renewed buying

In a downtrend, price may rise toward the trendline and then bounce lower, signalling renewed selling

Bonus insight:

A break and retest of a trendline can offer high-probability trade setups when supported by other confirmation tools.

Combining Trendlines with Indicators

While trendlines are standalone tools, their accuracy improves when combined with other indicators or chart patterns. Some effective combinations include:

Candlestick patterns (e.g., pin bars, bullish/bearish engulfing)

Moving averages that align with the trendline

Fibonacci retracement levels for confirming bounce zones

Momentum indicators to validate trend strength

Example:

A pin bar or bullish engulfing pattern near a trendline support adds conviction to a buy trade. Similarly, if a Fibonacci level overlaps the trendline, it becomes a strong confluence zone.

Points to Remember

Trendlines are essential tools for spotting trend direction and trade opportunities

No fixed rule defines the "correct" way to draw a trendline—some use wicks, others use closing prices

Ensure sufficient touchpoints for the trendline to be valid

Avoid force-fitting trendlines to suit your bias. Objectivity is key

Always trade with a well-defined stop loss to manage risk